❔ Choosing Channels

A guide on how to use call channels to make profit with our Channel Sniping method.

Doing analysis on call channels is an essential part of choosing the right ones and knowing what values to set in the Channel Snipe auto-trader. Different channels have different risk tolerance and therefore win to loss ratios. For example a gambles channel may have higher ROI but more susceptible to higher loss ratios as many promoted tokens are gambles whereas a more safe channel that calls higher mcap tokens may not get as many X's but allow for trading with higher amounts of capital and lower ROI.

Call frequency is also important to understand when setting up the Channel Sniper due to the fact that some may promote 10-20 tokens per day while others may only do a few per month and so it is important to break down the statistics on each channel for many factors to accommodate the values chosen for deployment of capital per trade and duration that capital should last in order to have the highest chances to make profits.

For analysis we will use ...

And we will give a few examples on how to use it followingly. Upon entering the bot you will see this message.

Enter the call channel in either @channelname or t.me/channelname format to pull stats from the channel.

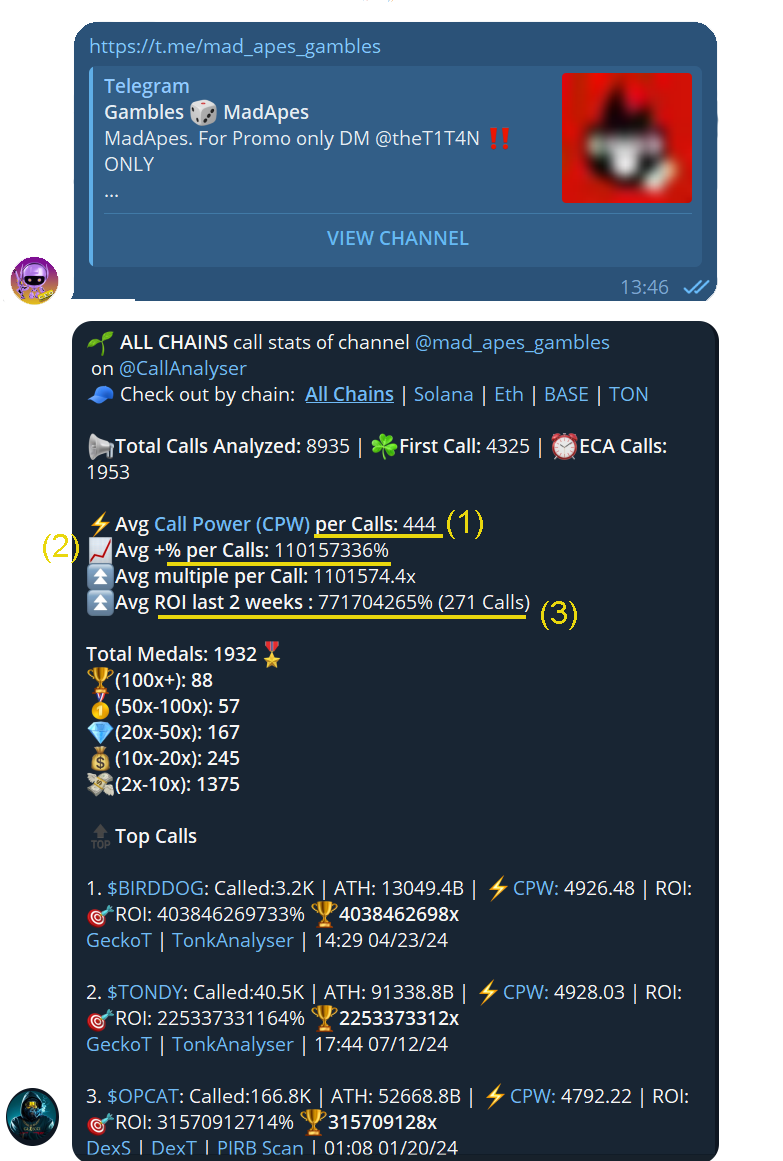

There are 3 main things to look out for when choosing a channel Snipe Calls from.

1) Call Power: This is a factor based on the MCAP and % increase and a few other factors, it essentially gives a rating to the channel with the rule of thumb the higher the call power, the better calls to expect from the channel.

2) Average % + gain per call. Pretty self explanatory, a average of all calls made by the channel and potential returns.

3) Average ROI last 2 weeks, is average % increase from entry for the calls made over the last 2 weeks.

You can refine many stats and check the channel for historical performance say over the last 10 days to see average ROI and worst loss and then structure your strategy around this to set values for the Channel Sniper.

We will dive into a practical example next based on the last 10 days from @mad_apes_gambles and base this on 9 trades.

Lets first count the ROI's on the last 10 calls:

Trade 1: 0%

Trade 2: 34%

Trade 3: 270%

Trade 4: 174%

Trade 5: 173%

Trade 6: 16%

Trade 7: 51%

Trade 8: 1215%

Trade 9: 169%

Say you want to invest 0.1 ETH over these 9 calls equating to 0.9 ETH as the max spend.

So based upon this you could structure your Auto-trade like this. Set Stop loss for -50% which will cut you out of 4 trades at -50% (0%, 34%, 16%, 51%) equating to a 0.2 ETH loss.

And then set a take profit to sell your bag at 1.5X so you would have won on 5 trades (270%, 174%, 173%, 1215%, 196%)

5 * (0.1 (initial) + 0.15 (gain 150%)) on each call = 1.25 ETH + 0.2 from SL on the other 4 lost trades.

= 0.55E profit

Please be advised that this is a very oversimplified calculation and your strategy may or may not work based on different timeframes e.g bull run you might get many more wins and bear market you may not get very much ROI, so please adjust strategy with intuition and by evaluating the market prior to setting values for Channel Snipe for best results.

For getting started with Sniping Channels please visit ...

📣 Channel Sniping